1099-K Reporting Requirements 2025 - Clarifications and Complexities of the New 1099K Reporting, Here’s what else you need to know. If you meet the applicable threshold,. The enforcement threshold was $20,000 last year.

Clarifications and Complexities of the New 1099K Reporting, Here’s what else you need to know.

1099 K Reporting Requirements 2025 Nevsa Adrianne, Is the ebay reporting threshold changing in 2025?

What is Form 1099K for Small Businesses? Block Advisors, Why does the new threshold matter?

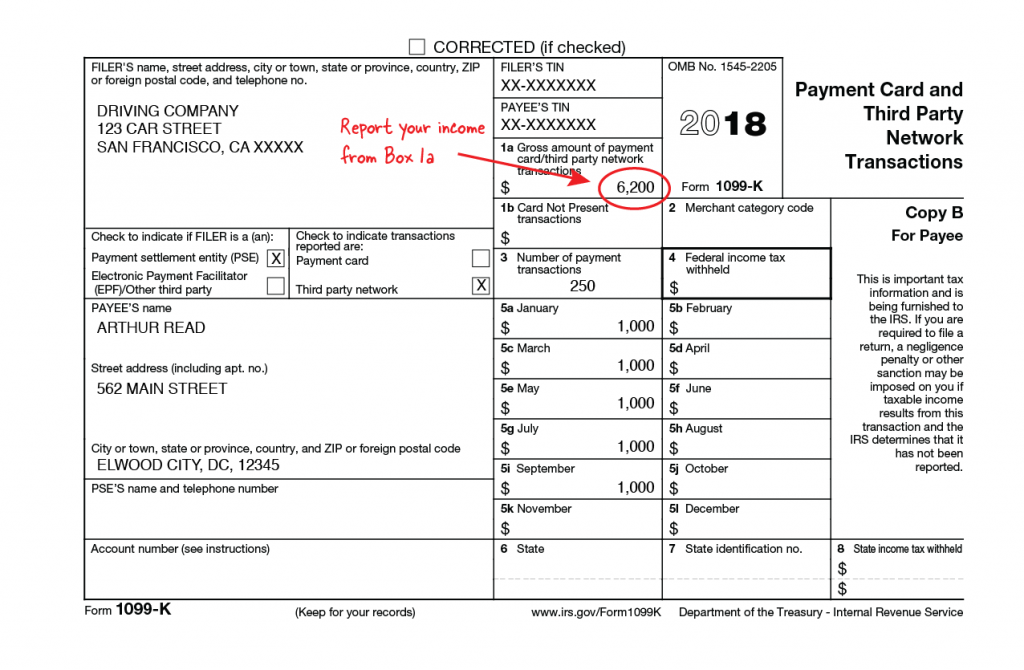

Irs 1099 Form 2025 Online Etta Kathrine, Learn about the 2025 $5,000 limit, the 2025 transition to $2,500, and the $600 threshold effective 2026.

What Is A 1099K? — Stride Blog, If you meet the applicable threshold,.

Reporting Requirements CLIENT PORTAL, On november 21, 2023, the irs announced it would further delay the full implementation of the law.

1099-K Reporting Requirements 2025. This story is part of taxes 2025,. On november 21, 2023, the irs announced it would further delay the full implementation of the law.

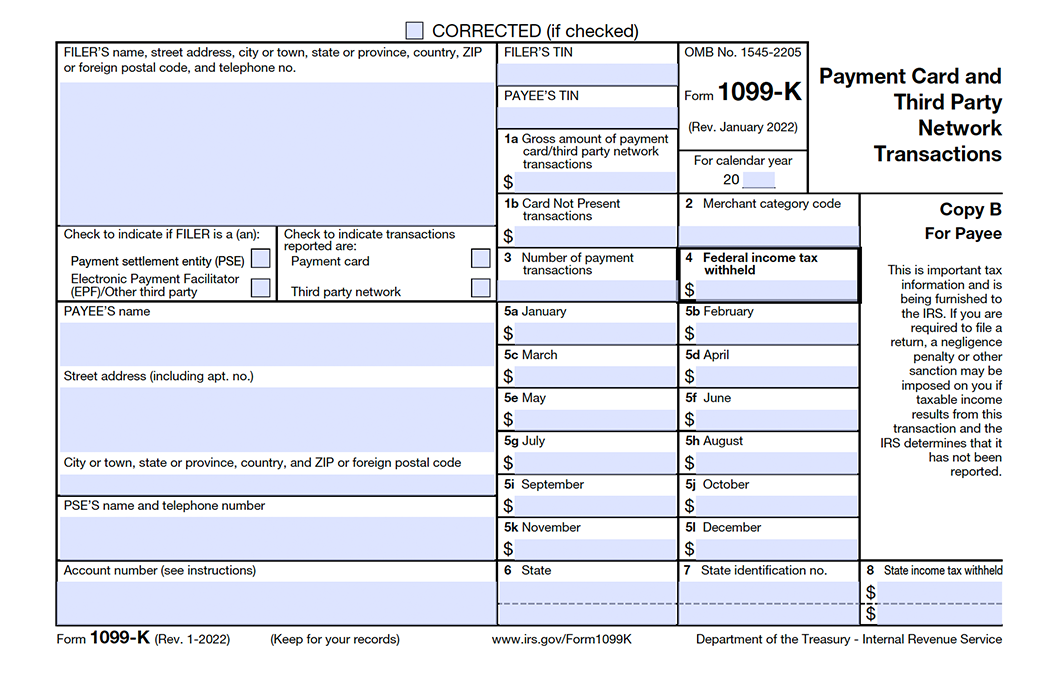

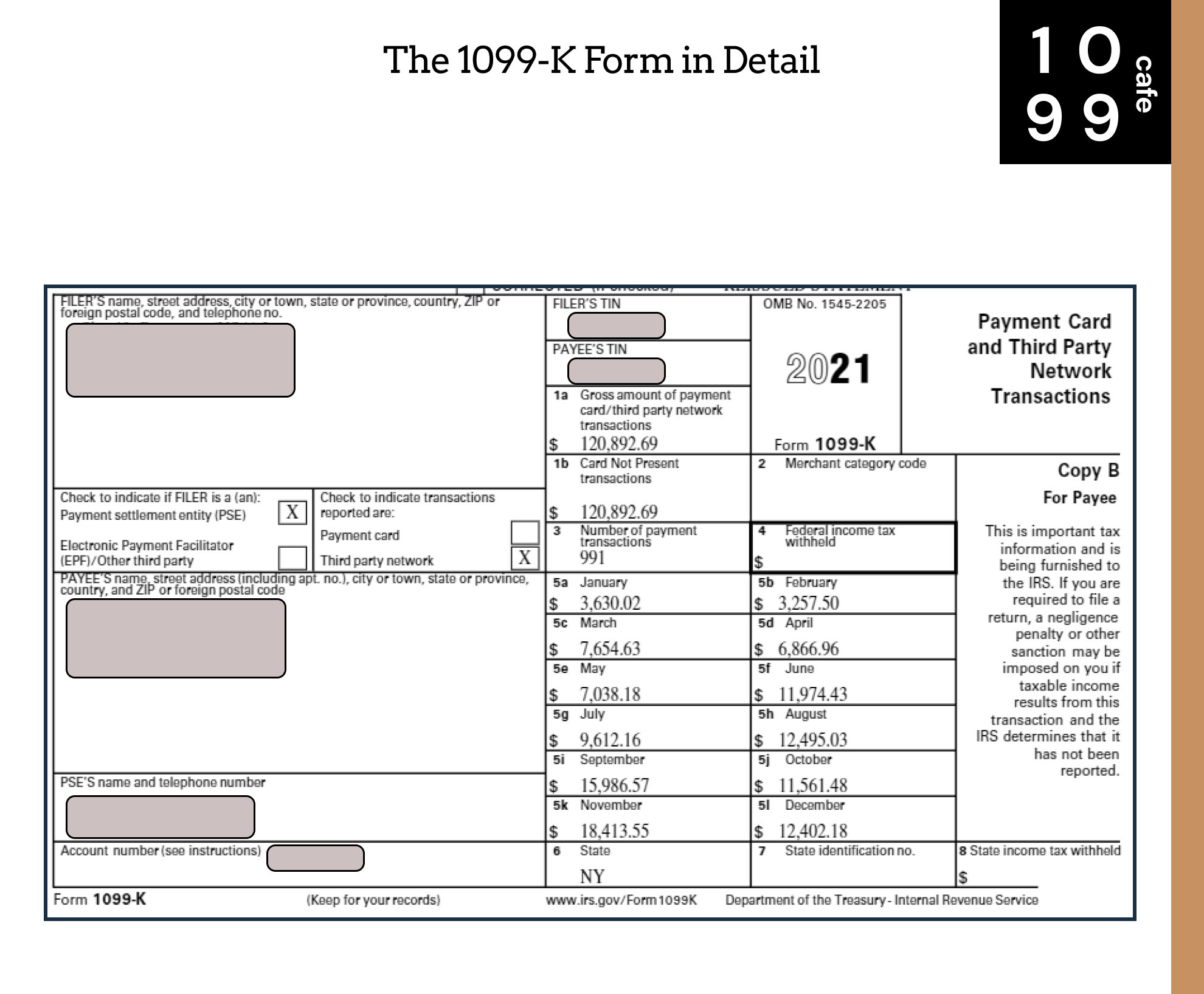

1099K vs 1099NEC 2025 Freelancing 1099 Forms Guide — 1099 Cafe, It is set at $2,500 for 2025 and $600 afterwards.

What is a 1099K? Form 1099 K Instructions, 26 set the reporting threshold at $5,000 for 2025, $2,500 in 2025, and $600 for 2026 and.

PPT 1099 K Printable 1099 K Form 1099 Online Tax 1099 K 2025, The irs recently released guidance on 2025 reporting.

IRS Form 1099K Your Complete Guide to Reporting Online Transactions, Learn about the 2025 $5,000 limit, the 2025 transition to $2,500, and the $600 threshold effective 2026.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)